Say what?! You can finance a timeshare? It may surprise you to learn this, but you can finance a timeshare. In fact, with our friends at Vacation Club Loans, getting a timeshare loan is straightforward and efficient. You’ll have low rates, no pre-payment penalties, and an easy approval process. Whether you want to visit ski resorts, oceanfront properties, amusement park properties or anything else, this guide will teach you how to finance a timeshare.

Should You Finance a Timeshare?

Most people finance their primary homes, cars, furniture, and now even smartphones. For those who vacation regularly and strive to make unforgettable memories on family trips, timeshares are an ideal fit. While some people say you shouldn’t finance something if you can’t pay for it in full, it’s at least important to know the option is out there.

Vacation ownership can bring years of memories in top resorts with the best hospitality brands without breaking the bank on a lifetime of vacations. What’s more, the timeshare resale marketplace can save families even more, with contracts sold at less than a fraction of the price.

Buying directly from a developer has perks, like exclusive benefits or extra flexibility. However, it can cost thousands more to buy directly from the top vacation clubs out there. It’s ultimately up to you if you should finance your ownership. Keep in mind, however, that financing a timeshare resale can make your vacations that much more affordable. If you were thinking of buying a timeshare but thought that it would be a financial burden, then maybe financing would be the best option for you.

How to Finance a Timeshare Resale

The first step is deciding on what vacation ownership will fit best with your travel lifestyle. Are you interested in spending the same week at the same resort yearly? Are you looking for a little more flexibility than that? Beaches or mountains? Family-friendly or weekend getaways? Points or weeks? These are all critical questions to consider when you’re on the market for a timeshare resale. There is something for every travel style, so you want to make sure to find the perfect fit. If you don’t love it, you might not find it worthwhile to obtain financing on a lifetime of vacations.

Find the Right Timeshare Lenders

This is a huge step. While there are plenty of online lenders, you want to make sure you find one that is licensed and reputable. Timeshare financing lenders like Vacation Club Loans offer fast loan approval, low interest rates, and no hidden fees. They are also proud members of the American Resort Development Association (ARDA), adhering to a strict code of ethics and guidelines to provide timeshare consumers with the utmost care and guidance.

VCL’s annual rates start at 11.9% for Disney Vacation Club resales and go up to 13.9% for other brands like Marriott, Hilton, Hyatt, and Westin. Depending on your credit, you can have the timeshare resale of your dreams. They offer up to ten years of loans over $8,000 and up to seven years for loans under $8,000.

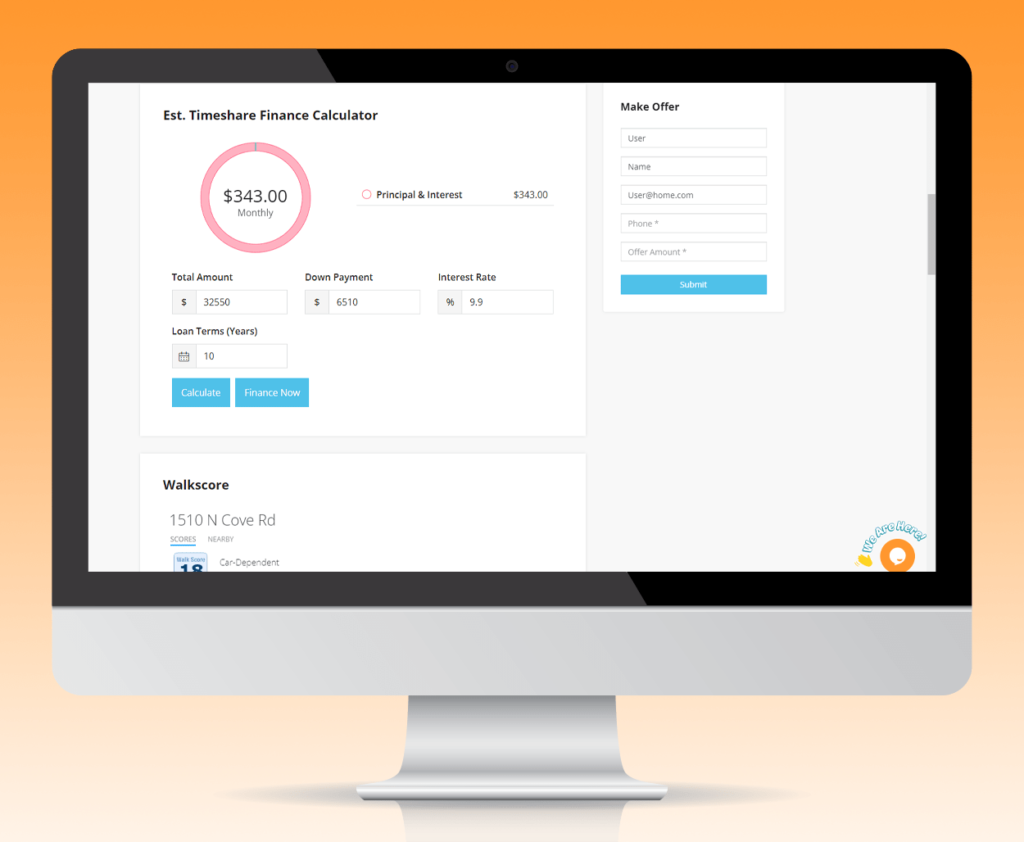

Timeshare Financing Calculator

Our website also has a loan calculator on every listing, so you can set your own terms and down payment. This makes it easier to estimate how much you will want to finance and what your monthly payments will look like. Every listing on our website includes this calculator, so you can see financing estimates without ever leaving the page.

Simply scroll down to the “Est. Timeshare Finance Calculator” section on the listing page to begin. There, you’ll enter in all of your potential financing information. Then, hit “Calculate” to see the estimate. It’s that simple! If you’re ready to finance, click on the “Finance Now” button to head to our timeshare financing home page.

From there, you can learn more about VCL and how to apply for timeshare financing with Vacation Club Loans. After you apply, a representative will reach out to you to further discuss financing. VCL representatives are experts in timeshare financing, so they will be able to answer any questions that you may have. Once you are approved, you can then make an offer on a timeshare! Easy as that!

How Easy is it to Get Financing On A Timeshare?

As long as you have good credit, you might find it pretty easy to get financing on a timeshare! Having good credit means you’ve paid bills on time without missing any payments and have a healthy history of credit. Timeshare lenders like Vacation Club Loans offer easy, fast online approval. All you have to do is find the timeshare you want to buy and apply for financing on our website!

Can I Finance a Timeshare With Bad Credit?

With just a 600 FICO, VCL will approve your loan application with up to ten-year terms. Not to mention, your debt will be confidential. VCL does not report to any credit bureaus, but they will need to retrieve your credit score before approving a loan.

Currently, Vacation Club Loans is accepting all DVC credit applications with no minimum credit score. 100% of all DVC loans are now approved, no matter the FICO score, with VCL new No Credit Check option. This is a huge step towards DVC ownership being accessible to all!

Vacation Club Loans are easy and straightforward. You can get estimated payments on their website based on the loan amount, the brand you wish to buy, and your credit score. If you are happy with the results you get back, consider applying online. Vacation Club Loans offers fast loan approval so you can get started taking the vacations of your dreams. No prepayment penalties. Finance up to 90% of the purchase price. No minimum loan amount. No loan origination fees.

How Financing a Timeshare Works With Vacation Club Loans

When you send in a timeshare loan request, you’ll get a quick response about whether or not you pre-qualify. From there, expert loan specialists will send you an email with personalized financing options. After you review and accept your loan, you’ll sign loan documents and be able to buy a timeshare. No need to sit through a long timeshare presentation, just find the one you like and make an offer! It’s really that simple. No matter what timeshare developer you’re interested in, Vacation Club Loans has a fast online approval process and competitive rates to help you buy a timeshare. Ready to get started? Then click on the link below!

Is a Timeshare Worth It?

Of course, with all these factors in mind, you may be wondering if timeshare ownership is right for you. The answer is that it depends! Timeshare owners enjoy grand amenities like on-site restaurants, movie theaters, and mini golf courses, as well as accommodations that are three times the size of your average hotel room. They also have the peace of mind that comes with knowing they don’t have to constantly book new hotel rooms each year, alongside other perks like vacation exchange. With that said, there are costs that all timeshare owners have to consider. Any timeshare property will come with maintenance fees to keep it in peak condition, but in exchange, you get to enjoy all the perks of a luxurious vacation property.

Learn more: Timeshare vs Hotel: Which is Right for You?

Timeshares Are Not an Investment

It’s important to keep in mind that timeshares are not an investment, and you should not be making a timeshare purchase simply to make a profit on it in the future. Timeshares, like many other luxury products, depreciate in value over time, so the resale value of your timeshare may not be as high as it was when you purchased it. Of course, some timeshare properties from a timeshare developer like Disney Vacation Club may sometimes retain their monetary value, but this should not be the expectation when buying a timeshare.

How to Save Even More Money on Timeshares

As we’ve mentioned before, there’s a great way to save money on your timeshare purchase, which will, in turn, make it easier to manage timeshare loans: buying a timeshare on the resale market. With the resale market, timeshare ownership becomes much more affordable while still letting you enjoy all of the luxurious amenities and spacious accommodations you would get when buying directly from a timeshare developer. You’ll still have to manage annual maintenance fees, but it’s a great way to bring your overall costs for a timeshare property down.

Want to learn more about how the resale market can save you money? Then check out our video, “Buying Timeshare Resale vs Direct: What to Know.”

Browse Timeshares for Sale

Ready to buy a timeshare resale? Browse our timeshares for sale online now from top brands like Disney Vacation Club, Marriott Vacation Club, Hilton Grand Vacations, and more. Once you find the right listing for you, use the timeshare financing calculator to see the estimated loan amount. If you’re ready to apply for financing, simply hit the “Finance Now” button on the listing page to get started! You can avoid very high interest rates with a Vacation Club Loans loan agreement, what’s not to love? We know that deciding to buy a timeshare can be daunting, but we’re here to help. We can help you find the perfect vacation ownership for your family without any pressure. You can contact a timeshare sales agent at 1-800-410-8326 or [email protected].